Baghdad: Two and a half years after the toppling of dictator Saddam Hussein, Iraq has voted in favour of a new democratic constitution, the country's electoral commission announced here Tuesday. (new.kerala.com)

Oct. 26 (Bloomberg) -- Federal Reserve Chairman Alan Greenspan, in the final months of his 18-year tenure atop the U.S. central bank, said economic forecasting models should be used with care and that data are important in shaping policy.

``Alan Greenspan has set the standard for excellence in economic policy making,'' Bernanke said yesterday. ``If I am confirmed to this position, my first priority will be to maintain continuity with the policies and policy strategies established during the Greenspan years.'' Oct. 26 (Bloomberg)

Oct. 20 (Bloomberg) -- China's economy grew 9.4 percent in the third quarter as rising wages spurred consumer spending and the government encouraged investment in coal mines and railways

Cindy Sheehan, the so-called "peace mom" on a crusade to end U.S. involvement in the Iraq war, is publicly blasting Sen. Hillary Clinton, D-N.Y., for her continued support of the ongoing conflict. (world net daily)

Indiana guard Stephen Jackson believes the NBA's new ban on bling- bling is racially motivated, but says he will abide by the rules. (AP)

Rigid labour markets and excessive red tape are deterring US investment in Europe and pose a "huge danger" to the continent's economy, Fred Smith, chief executive of FedEx, has warned. (MSNBC)

WASHINGTON, Oct. 19 (UPI) -- A vocal House Republican is calling for a new probe into what he says is a "witch-hunt" by defense officials against a Sept. 11 intelligence whistleblower. Rep. Curt Weldon, R-Penn., told United Press International that officials at the Defense Intelligence Agency, or DIA, had "conducted a deliberate campaign of character assassination" against the whistleblower, retired U.S. Army Lt. Col. Anthony Shaffer. Shaffer has said that a highly classified Pentagon data-mining project he worked on, codenamed Able Danger, identified the ringleaders of the Sept. 11 terror attacks as linked to al-Qaida more than a year before they hijacked four planes and crashed them, killing nearly 3,000 people.

UNITED NATIONS - A U.N. investigator, Detlev Mehlis, set the stage yesterday for increased international pressure on Syria, saying there is "converging evidence" that the Baathist regime in Damascus - including President al-Assad's brother-in-law Assef Shawkat - was involved in the assassination of a former Lebanese prime minister, Rafik Hariri, and that there is evidence that Mr. al-Assad himself had threatened Hariri. (NY SUN)

based on bank statements, Iraqi government documents and testimony from former Iraqi officials, found that (British lawmaker George) Galloway had received eight oil allocations totaling 23 million barrels from 1999 to 2003. It also found that Galloway's wife earned about $150,000 from one of the allocations. The report also asserts that payments totaling more than $1.6 million were paid to Saddam's regime in connection with the oil sales and a charity Galloway founded. (Mary Speck from The Congressional Quarterly)

UNITED NATIONS — More than 2,000 companies paid about $1.8 billion in illicit kickbacks and surcharges to Saddam Hussein's (search) government through extensive manipulation of the U.N. oil-for-food program in Iraq, according to key findings of a U.N.-backed investigation obtained by The Associated Press .

the Banque Nationale de Paris S.A., known as BNP, which held the U.N. oil-for-food escrow account, had a dual role and did not disclose fully to the United Nations the firsthand knowledge it acquired about the financial relationships that fostered the payment of illegal surcharges. (FOX NEWS)

NEW YORK, Oct 23 (Reuters) - After watching shares of CBOT Holdings Inc. more than double in value in their first days of trading, officials at rival exchanges that are still privately held may feel it is time for an initial public offering of their own, experts said. (Scott Malone, Reuters)

We surprised ourselves this quarter," Google CEO Eric Schmidt said during a Thursday interview. "Business was much stronger than I expected." (AP)

Demand has grown to the point where Toyota plans to raise annual production of hybrids to 400,000 vehicles next year from 300,000 this year. (AP)

October 27, 2005 -- J.P. Morgan Chase is rolling out an E-ZPass-styled credit card to capture the giant world of small cash transactions at movies, drug stores, delis and fast-food drive-throughs. (NY POST)

October 27, 2005 -- A top New York Stock Exchange official evaded questions from senators yesterday who asked him why the Big Board had blocked the listing of Life Sciences Research, a controversial medical testing company, the day the firm was to start trading. (NY POST)

Weekly discussion of financial markets, economics, politics, and the media. A member of Wall Street's Digital Underground since 1995

Friday, October 28, 2005

BOT,bling-bling, Google and I think we just got Bernanked

October 27, 2005

Happy Halloween,

I know you ask, what happened to the rally that was supposed to happen? Looks like the market once again has lost its mojo . We got ”Bernanked” I suspect, no it is not the new NBA dress code .It is simply that fact that after 18 years of Greenspeak ,the new chairman of the FED is operating under the Napoleonic code of guilt until proven innocence. Bond markets seem to be looking for a more energetic interest rate increaser. In the world of FED watchers he is well know, and know for his formulated systematic “black box” approach unlike Greenspan’s tinker and see method but in the real world he is hardly a house hold name, if you can figure out how to pronounce it. I prefer to judge him on the “duck test” ,if he walks like a duck ,talks like a duck he is a duck .He looks like a FED chief, sounds like a FED chief so he will probably make a good FED chief.

My fear at the moment is that we have not finished a sell off with a selling climax or rallied strongly from a much oversold position. The market cycle has gotten into a habit of taking a pause at each hurricane and we seem once again to be stuck in no were land. On the plus side financials continue to rally, IPO’s abound and mergers and acquisitions are many fold. If the investment banking business is brisk an Wall Street Profits are brisk then it is usually not long before the markets starts to drive up ward.

Many of you have asked me , “ hey dude why the waves on you’re website” ?

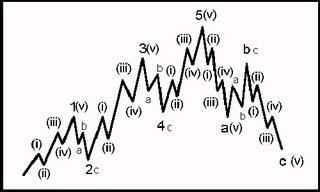

The Elliott Wave Theory was the work of R.N. Elliott, who observed more than a half-century ago that stock market movements unfold in a series of rhythmic patterns which are based on a natural progression of shifts in mass investor psychology. As market participants vacillate between greed and fear, price patterns develop. These price patterns are called “waves”.

I am a practitioner of my own brand of the “Elliott Wave Theory”. I am not a purist but I subscribe to the basic principles behind the Elliott Wave Theory. The Elliott Wave Theory interprets market actions in terms of recurrent price structures. Basically, Market cycles (WAVES) are composed of two major types of Wave: Impulse Wave and Corrective Wave. For every impulse wave, it can be sub-divided into 5 - wave structure (1-2-3-4-5), while for corrective wave, it can be sub-divided into 3 - wave structures (a-b-c).In this fashion the Elliott Wave Theory tracks the ebbs and flows of the market.

The most difficult part of Elliott Wave analysis is correctly labeling and counting the waves, another words trying to figure out what wave pattern you are in and were you are in that wave pattern. Like most forms of investing hind site is always 20/20.

In order to better ascertain were on the wave I am, I have coupled Elliott wave theory with Point and Figure charting ,mind you this is a hybrid trading system : Point & Figure charts consist of columns of X's and O's that represent filtered price movements over time. Their distinctive look may be alien at first to people who are more familiar with traditional price bar charts but once people learn the basics of P&F charts they usually become hooked.

There are several advantages to using P&F charts instead of the more traditional bar or candlestick charts. P&F charts automatically:

Eliminate the insignificant price movements that often make bar charts appear 'noisy.'

Remove the often misleading effects of time from the analysis process.

Make recognizing support/resistance levels much easier.

Make trend line recognition a 'no-brainer'.

Help you stay focused on the important long-term price developments.

James Foytlin

1(888)599-1188 toll free

www.jamesfoytlin.com

Happy Halloween,

I know you ask, what happened to the rally that was supposed to happen? Looks like the market once again has lost its mojo . We got ”Bernanked” I suspect, no it is not the new NBA dress code .It is simply that fact that after 18 years of Greenspeak ,the new chairman of the FED is operating under the Napoleonic code of guilt until proven innocence. Bond markets seem to be looking for a more energetic interest rate increaser. In the world of FED watchers he is well know, and know for his formulated systematic “black box” approach unlike Greenspan’s tinker and see method but in the real world he is hardly a house hold name, if you can figure out how to pronounce it. I prefer to judge him on the “duck test” ,if he walks like a duck ,talks like a duck he is a duck .He looks like a FED chief, sounds like a FED chief so he will probably make a good FED chief.

My fear at the moment is that we have not finished a sell off with a selling climax or rallied strongly from a much oversold position. The market cycle has gotten into a habit of taking a pause at each hurricane and we seem once again to be stuck in no were land. On the plus side financials continue to rally, IPO’s abound and mergers and acquisitions are many fold. If the investment banking business is brisk an Wall Street Profits are brisk then it is usually not long before the markets starts to drive up ward.

Many of you have asked me , “ hey dude why the waves on you’re website” ?

The Elliott Wave Theory was the work of R.N. Elliott, who observed more than a half-century ago that stock market movements unfold in a series of rhythmic patterns which are based on a natural progression of shifts in mass investor psychology. As market participants vacillate between greed and fear, price patterns develop. These price patterns are called “waves”.

I am a practitioner of my own brand of the “Elliott Wave Theory”. I am not a purist but I subscribe to the basic principles behind the Elliott Wave Theory. The Elliott Wave Theory interprets market actions in terms of recurrent price structures. Basically, Market cycles (WAVES) are composed of two major types of Wave: Impulse Wave and Corrective Wave. For every impulse wave, it can be sub-divided into 5 - wave structure (1-2-3-4-5), while for corrective wave, it can be sub-divided into 3 - wave structures (a-b-c).In this fashion the Elliott Wave Theory tracks the ebbs and flows of the market.

The most difficult part of Elliott Wave analysis is correctly labeling and counting the waves, another words trying to figure out what wave pattern you are in and were you are in that wave pattern. Like most forms of investing hind site is always 20/20.

In order to better ascertain were on the wave I am, I have coupled Elliott wave theory with Point and Figure charting ,mind you this is a hybrid trading system : Point & Figure charts consist of columns of X's and O's that represent filtered price movements over time. Their distinctive look may be alien at first to people who are more familiar with traditional price bar charts but once people learn the basics of P&F charts they usually become hooked.

There are several advantages to using P&F charts instead of the more traditional bar or candlestick charts. P&F charts automatically:

Eliminate the insignificant price movements that often make bar charts appear 'noisy.'

Remove the often misleading effects of time from the analysis process.

Make recognizing support/resistance levels much easier.

Make trend line recognition a 'no-brainer'.

Help you stay focused on the important long-term price developments.

James Foytlin

1(888)599-1188 toll free

www.jamesfoytlin.com

Wednesday, October 19, 2005

Why the Waves on the website?

Why the Waves on the website?

The Elliott Wave Theory was the work of R.N. Elliott, who observed more than a half-century ago that stock market movements unfold in a series of rhythmic patterns which are based on a natural progression of shifts in mass investor psychology. As market participants vacillate between greed and fear, price patterns develop. These price patterns are called “waves”.

I am a practitioner of my own brand of the “Elliott Wave Theory”. I am not a purist but I subscribe to the basic principles behind the Elliott Wave Theory. The Elliott Wave Theory interprets market actions in terms of recurrent price structures. Basically, Market cycles (WAVES) are composed of two major types of Wave: Impulse Wave and Corrective Wave. For every impulse wave, it can be sub-divided into 5 - wave structure (1-2-3-4-5), while for corrective wave, it can be sub-divided into 3 - wave structures (a-b-c).In this fashion the Elliott Wave Theory tracks the ebbs and flows of the market.

The most difficult part of Elliott Wave analysis is correctly labeling and counting the waves, another words trying to figure out what wave pattern you are in and were you are in that wave pattern. Like most forms of investing hind site is always 20/20.

Tuesday, October 18, 2005

newest news

The core inflation rate hasn't accelerated since March, and U.S. Treasuries rose because the report suggested companies are having little success passing along higher fuel costs to consumers. (Bloomberg)

``There is no sign of an immediate pass through of energy to core prices, but consumers spent with abandon considering their lack of confidence in the continued health of the economy,'' said Christopher Low, chief economist at FTN Financial in New York. (Bloomberg)..you say what?

October 11, 2005 -- The NASD said it fined eight brokerages, including U.S. units of Prudential PLC and Lord Abbett & Co., almost $7.8 million for taking kickbacks from mutual funds. Commonwealth Financial Network, Mutual Service Corp., Lincoln Financial Advisors Corp., Lord Abbett Distributor LLC and four Prudential units steered clients into preferred funds in return for payments, the NASD said today in a statement. In return, the fund firms sent their trading business to the brokerages, the regulator said. (NY POST)

WASHINGTON - Concern is mounting over improper financial dealings between the world's largest "wealth management" company, UBS, and Cuba, as American officials probing the transactions said yesterday that $3.9 billion in laundered American currency may have landed in personal accounts controlled by the Cuban dictator, Fidel Castro. (NY SUN)

When, in April 2003, American troops liberating Iraq found $762 million in American cash in hideouts belonging to Saddam Hussein, the banknotes were traced to UBS and the ECI program. In the process of probing the origins of the Iraqi cash - which UBS has told congressional investigators was initially sent to the Central Bank of Iran - American investigators subsequently discovered that the Swiss bank had also provided $3.9 billion in American currency for Cuba, $1 billion for Iran, $30 million for Libya, and less than $1 million for Yugoslavia. Cuba, Iran, and Libya appear on the State Department's official list of state sponsors of terrorism. (NY SUN)

UNITED NATIONS - A former aide to Secretary-General Annan who previously served as France's ambassador to the United Nations, Jean-Bernard Merimee, was captured yesterday in Paris as part of a French investigation into the oil-for-food program. (NY SUN)

WASHINGTON - The Islamic Republic of Iran has emerged as a central player in ongoing investigations into possible money laundering by the world's largest "wealth management" firm, UBS, as congressional staff disclosed yesterday that $762 million in American currency controlled by Saddam Hussein may have made its way from the Swiss bank to Iraq via the Central Bank of Iran. (NY SUN)

Oct. 11, 2005 — The original informant who prompted the terror alert on New York City's subways last week is sticking to his story, and there is no basis to conclude the threat was a hoax, sources involved in the investigation of the plot told ABC News.

(CNSNews.com) - A former president of the New Orleans City Council and member of the Orleans Levee Board blames corruption "down to the bone" and "unbelievable ineptness" for the loss of life and injuries during and after Hurricane Katrina.

Oct. 18 (Bloomberg) -- Refco Inc., the broker reeling from a bad-debt scandal, filed for bankruptcy court protection and agreed to sell its futures-trading business to a group led by J.C. Flowers & Co. for $768 million.

``There is no sign of an immediate pass through of energy to core prices, but consumers spent with abandon considering their lack of confidence in the continued health of the economy,'' said Christopher Low, chief economist at FTN Financial in New York. (Bloomberg)..you say what?

October 11, 2005 -- The NASD said it fined eight brokerages, including U.S. units of Prudential PLC and Lord Abbett & Co., almost $7.8 million for taking kickbacks from mutual funds. Commonwealth Financial Network, Mutual Service Corp., Lincoln Financial Advisors Corp., Lord Abbett Distributor LLC and four Prudential units steered clients into preferred funds in return for payments, the NASD said today in a statement. In return, the fund firms sent their trading business to the brokerages, the regulator said. (NY POST)

WASHINGTON - Concern is mounting over improper financial dealings between the world's largest "wealth management" company, UBS, and Cuba, as American officials probing the transactions said yesterday that $3.9 billion in laundered American currency may have landed in personal accounts controlled by the Cuban dictator, Fidel Castro. (NY SUN)

When, in April 2003, American troops liberating Iraq found $762 million in American cash in hideouts belonging to Saddam Hussein, the banknotes were traced to UBS and the ECI program. In the process of probing the origins of the Iraqi cash - which UBS has told congressional investigators was initially sent to the Central Bank of Iran - American investigators subsequently discovered that the Swiss bank had also provided $3.9 billion in American currency for Cuba, $1 billion for Iran, $30 million for Libya, and less than $1 million for Yugoslavia. Cuba, Iran, and Libya appear on the State Department's official list of state sponsors of terrorism. (NY SUN)

UNITED NATIONS - A former aide to Secretary-General Annan who previously served as France's ambassador to the United Nations, Jean-Bernard Merimee, was captured yesterday in Paris as part of a French investigation into the oil-for-food program. (NY SUN)

WASHINGTON - The Islamic Republic of Iran has emerged as a central player in ongoing investigations into possible money laundering by the world's largest "wealth management" firm, UBS, as congressional staff disclosed yesterday that $762 million in American currency controlled by Saddam Hussein may have made its way from the Swiss bank to Iraq via the Central Bank of Iran. (NY SUN)

Oct. 11, 2005 — The original informant who prompted the terror alert on New York City's subways last week is sticking to his story, and there is no basis to conclude the threat was a hoax, sources involved in the investigation of the plot told ABC News.

(CNSNews.com) - A former president of the New Orleans City Council and member of the Orleans Levee Board blames corruption "down to the bone" and "unbelievable ineptness" for the loss of life and injuries during and after Hurricane Katrina.

Oct. 18 (Bloomberg) -- Refco Inc., the broker reeling from a bad-debt scandal, filed for bankruptcy court protection and agreed to sell its futures-trading business to a group led by J.C. Flowers & Co. for $768 million.

supply and demand

October 17th, 2005

Hello,

What’s it going to take to get this market going? The good news continues to ad up even though you would never know it.

Yes the FED frets over inflation, but you don’t have to be a Nobel prize winner to know that New Orleans is a major shipping port in USA and to take it out of service raises more than oil and natural gas prices, include coffee, and lumber and many other commodities as well as the destruction to fishing and housing, and industry in the gulf region, all increase pricing pressures. Weather this is the beginning of a sustained period of inflation remains to be seen. As anyone who buys gas a lot over the last several months knows that energy prices can be quite volatile. In the long run it may be meaningless. Productivity growth may simply absorb increased energy prices. I do think we are in a period of prolonged increase in energy prices, but as we have seen in the past, increases in efficiency of energy use, last for ever but take time to implement. The out sized profits in the energy business will sooner or later be converted into investment into the energy infrastructure. It is import to point out raising prices in themselves do not necessarily mean inflation; sometimes it is just that demand is much greater than supply. Strong demand and low supply push prices up (law of supply and demand). Supply can also be constrained, not only by a dissipating asset but by foolish policies of regulation and taxation or just plain poor business practices. To be inflationary prices must increase in excess of excess demand. I am not really sure that is currently the case, so like I said the jury is still out on inflation.

I know you have all been distracted by a potential pandemic of bird flu, energy crisis, the war on terror, pictures of Karl Rove’s garage and Monday night football. You may have simply not noticed that we are near the anniversary of the 1987 October 19th stock market crash. We also had a mini crash in 1997 on the very same date. Since that time the first 3 weeks or so of October have been very scary. There will be some kind of a catalyst that will turn this market around in a big way .What exactly the catalyst will be I am not sure, but sure as Halloween always comes at the end of October, the market turns and takes off.

Is this becoming a lost decade for stock investing? After all we are starting to look like the market will be down for the first times ever for a full 10 years? Folks as with inflation the jury is still out but if the past is any guide the last 4 years of any decade seem to be the sweet spot. After all look at the roaring 80’s and 90’s the market in both looked rather pathetic the first 5 years then as they say the rest was history.

James

Hello,

What’s it going to take to get this market going? The good news continues to ad up even though you would never know it.

Yes the FED frets over inflation, but you don’t have to be a Nobel prize winner to know that New Orleans is a major shipping port in USA and to take it out of service raises more than oil and natural gas prices, include coffee, and lumber and many other commodities as well as the destruction to fishing and housing, and industry in the gulf region, all increase pricing pressures. Weather this is the beginning of a sustained period of inflation remains to be seen. As anyone who buys gas a lot over the last several months knows that energy prices can be quite volatile. In the long run it may be meaningless. Productivity growth may simply absorb increased energy prices. I do think we are in a period of prolonged increase in energy prices, but as we have seen in the past, increases in efficiency of energy use, last for ever but take time to implement. The out sized profits in the energy business will sooner or later be converted into investment into the energy infrastructure. It is import to point out raising prices in themselves do not necessarily mean inflation; sometimes it is just that demand is much greater than supply. Strong demand and low supply push prices up (law of supply and demand). Supply can also be constrained, not only by a dissipating asset but by foolish policies of regulation and taxation or just plain poor business practices. To be inflationary prices must increase in excess of excess demand. I am not really sure that is currently the case, so like I said the jury is still out on inflation.

I know you have all been distracted by a potential pandemic of bird flu, energy crisis, the war on terror, pictures of Karl Rove’s garage and Monday night football. You may have simply not noticed that we are near the anniversary of the 1987 October 19th stock market crash. We also had a mini crash in 1997 on the very same date. Since that time the first 3 weeks or so of October have been very scary. There will be some kind of a catalyst that will turn this market around in a big way .What exactly the catalyst will be I am not sure, but sure as Halloween always comes at the end of October, the market turns and takes off.

Is this becoming a lost decade for stock investing? After all we are starting to look like the market will be down for the first times ever for a full 10 years? Folks as with inflation the jury is still out but if the past is any guide the last 4 years of any decade seem to be the sweet spot. After all look at the roaring 80’s and 90’s the market in both looked rather pathetic the first 5 years then as they say the rest was history.

James

Tuesday, October 11, 2005

more "Kumbayah crap"

WASHINGTON - The American government is demanding that Saudi Arabia account for its distribution of hate material to American mosques, as the State Department pressed Saudi officials for answers last week and as the Senate later this month plans to investigate the propagation of radical Wahhabism on American shores. (NY SUN)

Iran was today accused by Britain of supplying Iraqi insurgents with the technology and explosives to kill its soldiers in the south of the country. A senior government official, briefing correspondents in London, said that there was evidence that the Iranians were in contact with insurgent groups fighting coalition forces in Iraq.

(http://www.guardian.co.uk)

UNITED NATIONS — United Nations investigators scrambling to discover the extent of a bribery scandal spreading out from the organization's procurement department may soon be looking toward the building's 38th floor — the U.N's executive offices.( Claudia Rosett and George Russell)

"It all circles back to fears of inflation and fears of further rate increases" by the Federal Reserve, said Larry Peruzzi, and equity trader at Boston Company Asset Management. (WSJ)

WASHINGTON -- Amid growing concerns about bird flu spreading to humans, the Bush administration says it plans to bolster vaccine production in the U.S., purchase huge quantities of antiviral drugs and lay out a detailed system to coordinate federal, state and local response efforts to a pandemic. (WSJ)

WASHINGTON -- The Bush administration opposes a bailout of municipal bondholders on the hurricane-ravaged Gulf Coast, Treasury Secretary John Snow told Congress. (WSJ)

Democrats need to cut the “Kumbayah crap” from their rhetoric, James Carville said Thursday night.

WASHINGTON - The world's largest "wealth management" firm, UBS, will be investigated by Congress for possibly laundering money for two state sponsors of terrorism, Cuba and Iran, lawmakers here told The New York Sun.

BERLIN – Conservative leader Angela Merkel confirmed a coalition deal that will make her Germany's first female chancellor under the terms of a power-sharing agreement that would end Social Democrat Gerhard Schroeder's seven years in office. (WSJ)

“If Schröder was a sprinter, Merkel is a long-distance runner,” says Wolfgang Nowak, head of the Alfred Herrhausen Society, a think-tank run by Deutsche Bank. She is considered extremely methodical, going through all the options before making a decision. Insiders call her a “learning machine”. And she has certainly learned a lot since Helmut Kohl picked her out of obscurity in 1991, not least from Mr Schröder’s often frustrated efforts to reform the economy.(the Ecomomist)

Will post-war Germany’s second grand coalition be a success? If history is any guide, a new marriage of elephants would neither disappoint nor over-perform. The first grand coalition, in 1966-69, worked through quite an impressive legislative agenda: emergency legislation, …(the Economist)

NEW YORK -- Refco Inc. said it discovered through an internal review that the company was owed about $430 million by an entity controlled by Chairman and Chief Executive Phillip Bennett, who has repaid the receivable, including accrued interest, in cash. Refco also said that Mr. Bennett is taking a leave of absence, at the request of Refco's board. Chief Operating Officer and Executive Vice President William Sexton, who previously planned to leave the company, agreed to remain at the financial-service company as CEO. (WSJ)

October 10, 2005 -- Giant Verizon is stepping up its battle to win control of wireless Internet business from a group of rivals offering popular Wi-Fi access. Verizon's effort comes in the wake of Philadelphia's government-backed effort to make the entire city a Wi-Fi hotspot — an area in which anyone could get on to the Internet without wires (NY POST)

Three explosive devices found in a courtyard between two Georgia Tech dormitories on the East Campus Monday morning were part of a "terrorist act," an Atlanta police official said. (http://www.11alive.com/news/news_article.aspx?storyid=70306 )

According to most reports, Joel Hinrichs III was a young man with a history of depression who used a homemade explosive device to commit suicide just 100 yards or so from the school’s football stadium, which was filled with over 80,000 people at the time. Officials were quick to call the incident a suicide, but rumors and reports of Hinrichs’ attempts to buy large quantities of ammonium nitrate and ties to the Muslim community have raised a lot of questions and the answers thus far are not forthcoming. (http://www.cbsnews.com/blogs/2005/10/10/publiceye/entry931118.shtml )

Boys and young men in the key demographic group reported watching a whopping 24 percent fewer films in the all-important summer cinema season in 2005 than they did over the same period in 2003, consumer research firm Online Testing eXchange (OTX) said. "The perception among young male moviegoers that there wasn't much to see his year was a difficult barrier to overcome, regardless of price," said Vincent Bruzzese of OTX. (AFP)

Iran was today accused by Britain of supplying Iraqi insurgents with the technology and explosives to kill its soldiers in the south of the country. A senior government official, briefing correspondents in London, said that there was evidence that the Iranians were in contact with insurgent groups fighting coalition forces in Iraq.

(http://www.guardian.co.uk)

UNITED NATIONS — United Nations investigators scrambling to discover the extent of a bribery scandal spreading out from the organization's procurement department may soon be looking toward the building's 38th floor — the U.N's executive offices.( Claudia Rosett and George Russell)

"It all circles back to fears of inflation and fears of further rate increases" by the Federal Reserve, said Larry Peruzzi, and equity trader at Boston Company Asset Management. (WSJ)

WASHINGTON -- Amid growing concerns about bird flu spreading to humans, the Bush administration says it plans to bolster vaccine production in the U.S., purchase huge quantities of antiviral drugs and lay out a detailed system to coordinate federal, state and local response efforts to a pandemic. (WSJ)

WASHINGTON -- The Bush administration opposes a bailout of municipal bondholders on the hurricane-ravaged Gulf Coast, Treasury Secretary John Snow told Congress. (WSJ)

Democrats need to cut the “Kumbayah crap” from their rhetoric, James Carville said Thursday night.

WASHINGTON - The world's largest "wealth management" firm, UBS, will be investigated by Congress for possibly laundering money for two state sponsors of terrorism, Cuba and Iran, lawmakers here told The New York Sun.

BERLIN – Conservative leader Angela Merkel confirmed a coalition deal that will make her Germany's first female chancellor under the terms of a power-sharing agreement that would end Social Democrat Gerhard Schroeder's seven years in office. (WSJ)

“If Schröder was a sprinter, Merkel is a long-distance runner,” says Wolfgang Nowak, head of the Alfred Herrhausen Society, a think-tank run by Deutsche Bank. She is considered extremely methodical, going through all the options before making a decision. Insiders call her a “learning machine”. And she has certainly learned a lot since Helmut Kohl picked her out of obscurity in 1991, not least from Mr Schröder’s often frustrated efforts to reform the economy.(the Ecomomist)

Will post-war Germany’s second grand coalition be a success? If history is any guide, a new marriage of elephants would neither disappoint nor over-perform. The first grand coalition, in 1966-69, worked through quite an impressive legislative agenda: emergency legislation, …(the Economist)

NEW YORK -- Refco Inc. said it discovered through an internal review that the company was owed about $430 million by an entity controlled by Chairman and Chief Executive Phillip Bennett, who has repaid the receivable, including accrued interest, in cash. Refco also said that Mr. Bennett is taking a leave of absence, at the request of Refco's board. Chief Operating Officer and Executive Vice President William Sexton, who previously planned to leave the company, agreed to remain at the financial-service company as CEO. (WSJ)

October 10, 2005 -- Giant Verizon is stepping up its battle to win control of wireless Internet business from a group of rivals offering popular Wi-Fi access. Verizon's effort comes in the wake of Philadelphia's government-backed effort to make the entire city a Wi-Fi hotspot — an area in which anyone could get on to the Internet without wires (NY POST)

Three explosive devices found in a courtyard between two Georgia Tech dormitories on the East Campus Monday morning were part of a "terrorist act," an Atlanta police official said. (http://www.11alive.com/news/news_article.aspx?storyid=70306 )

According to most reports, Joel Hinrichs III was a young man with a history of depression who used a homemade explosive device to commit suicide just 100 yards or so from the school’s football stadium, which was filled with over 80,000 people at the time. Officials were quick to call the incident a suicide, but rumors and reports of Hinrichs’ attempts to buy large quantities of ammonium nitrate and ties to the Muslim community have raised a lot of questions and the answers thus far are not forthcoming. (http://www.cbsnews.com/blogs/2005/10/10/publiceye/entry931118.shtml )

Boys and young men in the key demographic group reported watching a whopping 24 percent fewer films in the all-important summer cinema season in 2005 than they did over the same period in 2003, consumer research firm Online Testing eXchange (OTX) said. "The perception among young male moviegoers that there wasn't much to see his year was a difficult barrier to overcome, regardless of price," said Vincent Bruzzese of OTX. (AFP)

flu bug,Columbus and the 1987 crash and more "kumbayah crap"

October 6, 2005

Hello,

So here we are in October, and we all know that for some confluence of reasons perhaps it the season of Halloween but the market always seems to get “spooked” in a big way the first 2 weeks and then rebound strongly sometime during the end of the third week and begins the year ending rally. The rally that follows the October drop follows a first in first out principle with many of the leading sectors regaining there step proceeding the sell off. The sell off is market driven bigger than any single stock and global in scope. I have noticed this annual occurrence since October 19th 1987. So while we search for the market bottom and in celebration of new discoveries lets follow the lead of Columbus and sail west to go east another words, instead of panic selling in mid October lets capitalize on the yearly reoccurrence by looking to pick up shares in leading sectors on the cheap and as they say buy low and look to sell high. So what you ask would Columbus do?

Well in 1492, Columbus sailed the ocean blue….first he had a plan to find a direct route to the east ,for most it is simply a matter of financial security ,but you have to have a plan,2) he had perseverance ,short term set backs were no match for his long term vision ,he new what he had to do and he kept doing it ,we call this follow up 3)Columbus was also well diversified using three ships instead of one ,one large and two smaller and faster ships, when one ran aground the other pick up the slack, your portfolio should work the same 4) Columbus favored using ‘dead reckoning” instead of the strategy of coordinating points based on the position of the heavenly bodies. Columbus believed in knowing were you were and taking direct measurements form that point to identify were you are now. Investors can use the same to track their portfolio and understand where they are and what it will take to get were they want to be, instead of focusing on the stars.

James

www.jamesfoytlin.com

Hello,

So here we are in October, and we all know that for some confluence of reasons perhaps it the season of Halloween but the market always seems to get “spooked” in a big way the first 2 weeks and then rebound strongly sometime during the end of the third week and begins the year ending rally. The rally that follows the October drop follows a first in first out principle with many of the leading sectors regaining there step proceeding the sell off. The sell off is market driven bigger than any single stock and global in scope. I have noticed this annual occurrence since October 19th 1987. So while we search for the market bottom and in celebration of new discoveries lets follow the lead of Columbus and sail west to go east another words, instead of panic selling in mid October lets capitalize on the yearly reoccurrence by looking to pick up shares in leading sectors on the cheap and as they say buy low and look to sell high. So what you ask would Columbus do?

Well in 1492, Columbus sailed the ocean blue….first he had a plan to find a direct route to the east ,for most it is simply a matter of financial security ,but you have to have a plan,2) he had perseverance ,short term set backs were no match for his long term vision ,he new what he had to do and he kept doing it ,we call this follow up 3)Columbus was also well diversified using three ships instead of one ,one large and two smaller and faster ships, when one ran aground the other pick up the slack, your portfolio should work the same 4) Columbus favored using ‘dead reckoning” instead of the strategy of coordinating points based on the position of the heavenly bodies. Columbus believed in knowing were you were and taking direct measurements form that point to identify were you are now. Investors can use the same to track their portfolio and understand where they are and what it will take to get were they want to be, instead of focusing on the stars.

James

www.jamesfoytlin.com

Wednesday, October 05, 2005

Financial crimes and misdemeanors in the news

WASHINGTON -- House Majority Leader Tom DeLay was indicted by a Texas grand jury for campaign-finance violations, shaking the capital's Republican leadership and aggravating fissures within the party that could unsettle its decade-long dominance of Congress. (WSJ)

HCA Inc. said Thursday it has been informed that the Securities and Exchange Commission has issued a formal order of investigation relating to trading of the company's securities. The announcement relates to the SEC's probe of stock sales made by Senate Majority Leader Bill Frist, whose family founded the company.(WSJ)

September 29, 2005 -- Twelve top investment banks and financial institutions have been told they must defend a lawsuit claiming they participated in an industrywide scheme to rig initial public offerings. (NY POST)

September 29, 2005 -- The accounting disaster at Fannie Mae, the giant mortgage guarantor already in the midst of a multiyear investigation of financial shenanigans, appears to be much worse than previously thought. Investigators now say that the $11 billion estimate of Fannie Mae's accounting gimmicks appears to be a best-case scenario. (NY POST)

The two men who founded Bayou Management LLC, the Connecticut hedge-fund firm that allegedly exaggerated results for years before closing shop unexpectedly in July without returning investors' money, are expected plead guilty to criminal fraud charges in federal court today, a person familiar with the matter said. (WSJ)

The relisting of Parmalat stock will cap the turnaround of the Italian company by government-appointed administrator Enrico Bondi. He took control of the company -- best known for producing milk with a long shelf life -- when it filed for bankruptcy protection in December 2003 after the discovery of a decade-long fraud allegedly masterminded by former executives. (WSJ)

WASHINGTON -- The money that led to the indictment this week of two Las Vegas pastors and the wife of one of them came from federal grants arranged by Sen. Harry Reid in September 2001, a Reid spokeswoman said Wednesday.

( http://www.reviewjournal.com)

A detailed lawsuit filed against Delphi Corp. by two state pension funds and one of Europe's biggest employee-pension funds alleges the auto-supplier's senior executives encouraged inventory deals with a bank and two other companies that artificially boosted profits from 1999 to 2002. (WSJ)

HCA Inc. said Thursday it has been informed that the Securities and Exchange Commission has issued a formal order of investigation relating to trading of the company's securities. The announcement relates to the SEC's probe of stock sales made by Senate Majority Leader Bill Frist, whose family founded the company.(WSJ)

September 29, 2005 -- Twelve top investment banks and financial institutions have been told they must defend a lawsuit claiming they participated in an industrywide scheme to rig initial public offerings. (NY POST)

September 29, 2005 -- The accounting disaster at Fannie Mae, the giant mortgage guarantor already in the midst of a multiyear investigation of financial shenanigans, appears to be much worse than previously thought. Investigators now say that the $11 billion estimate of Fannie Mae's accounting gimmicks appears to be a best-case scenario. (NY POST)

The two men who founded Bayou Management LLC, the Connecticut hedge-fund firm that allegedly exaggerated results for years before closing shop unexpectedly in July without returning investors' money, are expected plead guilty to criminal fraud charges in federal court today, a person familiar with the matter said. (WSJ)

The relisting of Parmalat stock will cap the turnaround of the Italian company by government-appointed administrator Enrico Bondi. He took control of the company -- best known for producing milk with a long shelf life -- when it filed for bankruptcy protection in December 2003 after the discovery of a decade-long fraud allegedly masterminded by former executives. (WSJ)

WASHINGTON -- The money that led to the indictment this week of two Las Vegas pastors and the wife of one of them came from federal grants arranged by Sen. Harry Reid in September 2001, a Reid spokeswoman said Wednesday.

( http://www.reviewjournal.com)

A detailed lawsuit filed against Delphi Corp. by two state pension funds and one of Europe's biggest employee-pension funds alleges the auto-supplier's senior executives encouraged inventory deals with a bank and two other companies that artificially boosted profits from 1999 to 2002. (WSJ)

Financial crimes and misdemeanors

October 4 2005

Hello,

Is there no shame? From the UN to the halls of congress to boardrooms from sea to shining sea corruption seems to be the order of the day. What’s an investor to do? Yes some actions are out and out criminality, some are solely the province of an isolated single individual, some are debates of accounting tactics and tax payments and some are simply wild eyes accusations. Is corruption at epidemic proportions or is it simply ingrained in many institutions in our society? Many institutions acting more like criminal enterprises thinly veiled in a cloak of legitimacy.

Stocks that play by the rules ,follow proper accounting procedures and keep shareholders and employees informed ,in the long run they have their stocks rewarded .Companies that over pay their executives, and don’t act in the best interest of shareholders and employees are in the long run looked at with suspicion and their stock prices are penalized. We all know the stories of World com ,lucent, AT&T ,Enron and so on many of these stocks are no longer with us or trading at very low valuations. It is important to stay calm and separate acts of fraud, bad management or poor business judgment. Remember General Motors not selling enough SUV’s with $3 a gallon gasoline is not corruption it is just very bad management.

How do you know what they say is true? First there are accounting standards that are practiced uniformly in most parts of the world. Standards have some differences country to country but are generally uniform in most of the industrialized world. Most exchanges are self regulatory bodies and have standards of there own that companies have to meet to remain listed on their exchange. There are state administrators and Federal regulators that demand certain level of compliance with regulation and companies must demonstrate compliance to the regulators as well as the exchanges. Companies hire auditors, who are liable for the company meeting the regulatory requirements. It is also important to note that bulletin board or penny stocks have almost NO requirements and some countries have historically weak compliance and enforcement, Japan, Italy, Brazil for instance and some countries like China have no standards and are currently trying to develop standards, policies and procedures. However an Italian or Japanese or Brazilian stock that is listed on the New York Stock Exchange has to meet NYSE standards, US standards and there own country standards. This is not to cast dispersions on certain countries or companies .The USA was a model for transparency until the Clinton Era scandals of the 1990’s ie.. Enron, World Com and well you know the story…

So again what’s an investor to do? I have some simple rules, they don’t inoculate you against everything but it is a good place to start.

1) Don’t buy stocks that don’t have audited financials,2) Over hyped CEO’s often lead to underperforming stocks,3) It is what they do not what they say,4) longer term consistency of earning and revenue growth,5) the companies articulated strategy has to make sense. 6) The stock is listed on a major exchange like the NYSE which has even higher standards. 7) A company’s openness to share information with shareholders. It is important to remember that there are over 8000 mutual funds and about 8000 stocks so the amount of financial crimes is rather small, but often spectacular.

James

www.jamesfoytlin.com

http://onesmallvoice.blogspot.com/

Hello,

Is there no shame? From the UN to the halls of congress to boardrooms from sea to shining sea corruption seems to be the order of the day. What’s an investor to do? Yes some actions are out and out criminality, some are solely the province of an isolated single individual, some are debates of accounting tactics and tax payments and some are simply wild eyes accusations. Is corruption at epidemic proportions or is it simply ingrained in many institutions in our society? Many institutions acting more like criminal enterprises thinly veiled in a cloak of legitimacy.

Stocks that play by the rules ,follow proper accounting procedures and keep shareholders and employees informed ,in the long run they have their stocks rewarded .Companies that over pay their executives, and don’t act in the best interest of shareholders and employees are in the long run looked at with suspicion and their stock prices are penalized. We all know the stories of World com ,lucent, AT&T ,Enron and so on many of these stocks are no longer with us or trading at very low valuations. It is important to stay calm and separate acts of fraud, bad management or poor business judgment. Remember General Motors not selling enough SUV’s with $3 a gallon gasoline is not corruption it is just very bad management.

How do you know what they say is true? First there are accounting standards that are practiced uniformly in most parts of the world. Standards have some differences country to country but are generally uniform in most of the industrialized world. Most exchanges are self regulatory bodies and have standards of there own that companies have to meet to remain listed on their exchange. There are state administrators and Federal regulators that demand certain level of compliance with regulation and companies must demonstrate compliance to the regulators as well as the exchanges. Companies hire auditors, who are liable for the company meeting the regulatory requirements. It is also important to note that bulletin board or penny stocks have almost NO requirements and some countries have historically weak compliance and enforcement, Japan, Italy, Brazil for instance and some countries like China have no standards and are currently trying to develop standards, policies and procedures. However an Italian or Japanese or Brazilian stock that is listed on the New York Stock Exchange has to meet NYSE standards, US standards and there own country standards. This is not to cast dispersions on certain countries or companies .The USA was a model for transparency until the Clinton Era scandals of the 1990’s ie.. Enron, World Com and well you know the story…

So again what’s an investor to do? I have some simple rules, they don’t inoculate you against everything but it is a good place to start.

1) Don’t buy stocks that don’t have audited financials,2) Over hyped CEO’s often lead to underperforming stocks,3) It is what they do not what they say,4) longer term consistency of earning and revenue growth,5) the companies articulated strategy has to make sense. 6) The stock is listed on a major exchange like the NYSE which has even higher standards. 7) A company’s openness to share information with shareholders. It is important to remember that there are over 8000 mutual funds and about 8000 stocks so the amount of financial crimes is rather small, but often spectacular.

James

www.jamesfoytlin.com

http://onesmallvoice.blogspot.com/

Subscribe to:

Posts (Atom)