June 30,2006

Hello,

The FED used some “slightly toned down language” that sent stocks soaring under very heavy volume. Giving us one more step forward in this turn the corner bear to bull market ralley.

In its policy statement, the central bank said "Recent indicators suggest that economic growth is moderating from its quite strong pace earlier this year, partly reflecting a gradual cooling of the housing market and the lagged effects of interest rates and energy prices." The Fed further added that "the extent and timing of any additional firming that may be needed to address these risks will depend on the evolution of the outlook for both inflation and economic growth, as implied by incoming information." Previously the committee said, "Some further policy firming may yet be needed". Another quarter-point hike is expected at the August meeting. (IBD)

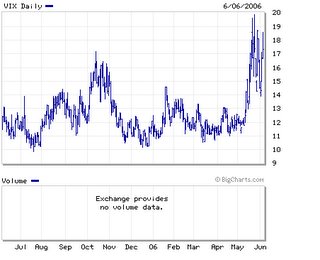

Again I will repeat a lot of volatility has to be created to get this flat line bear market moving. There are very clear parallels to the 1982 when the market finally took off in August creating the bull market that ending in 2000. If the FED is giving the signal they are topping out then the incremental interest rate increase environment will soon becoming to an end, the market will be doing some very serious catching up for the last 6 years of under performance. The transition period form bear to bull is treacherous, filled with volatility and finally very explosive on the upside.

James

www.jamesfoytlin.com

Weekly discussion of financial markets, economics, politics, and the media. A member of Wall Street's Digital Underground since 1995

Friday, June 30, 2006

Wednesday, June 28, 2006

news news news

Sales of existing homes fell for the seventh time in nine months in May as interest rates rose. (WSJ)

Tony Snow: 'The NEW YORK TIMES and other news organizations ought to think long and hard about whether a public's right to know in some cases might override somebody's right to live.'

American presence in Iraq is more dangerous to world peace than nuclear threats from North Korea or Iran, U.S. Rep. John Murtha, D-Pa., said to a crowd of more than 200 in North Miami Saturday afternoon. (South Florida Sun-Sentinel)

A wave of deals is putting 2006 on pace to be the most-active merger year ever, with a total value that could top $3.5 trillion. (WSJ)

GM said about 35,000 hourly workers agreed to take buyouts, letting the auto maker meet its job-cut target ahead of schedule. (WSJ)

Professor Bob Carter of the Marine Geophysical Laboratory at James Cook University, in Australia gives what, for many Canadians, is a surprising assessment: "Gore's circumstantial arguments are so weak that they are pathetic. It is simply incredible that they, and his film, are commanding public attention."

Appearing before the Commons Committee on Environment and Sustainable Development last year, Carleton University paleoclimatologist Professor Tim Patterson testified, "There is no meaningful correlation between CO2 levels and Earth's temperature over this [geologic] time frame. In fact, when CO2 levels were over ten times higher than they are now, about 450 million years ago, the planet was in the depths of the absolute coldest period in the last half billion years." Patterson asked the committee, "On the basis of this evidence, how could anyone still believe that the recent relatively small increase in CO2 levels would be the major cause of the past century's modest warming?"

DON’T FORGET TO CHECK OUT “LIFE OF AN ARTIST” ,A SOLO ART SHOW OF PAINTINGS BY KRISTINE D. PAIGE AT THE C. MAGOR GALLERY ,21 OAK STREET ,RIDGEWOOD NEW JERSEY 07450 SPECIAL OPEN RECEPTION THURDAY JUNE 29 FROM 5-9:30 CALL (201) 670-0555 WITH GUEST LECTURER JAMES J FOYTLIN ON THE VALUE OF INVESTING IN ART

Monday, June 26, 2006

Wednesday, June 21, 2006

Tuesday, June 20, 2006

Real Estate Fall Out

June 26th,2006

Hello,

Ok since you keep asking me about real estate;

Investor look to put capital to work to generate the maximum return weather it is real-estate, equities or anything else. Different economic situations create different sets of opportunities. Low interest rates and a declining stock market made real estate very appealing ,but The longest period of interest rate increases in a quarter of a century has begun to significantly impact the real estate market. Many people in real estate are trapped with huge mortgages and creeping property taxes or second homes that they find them selves over extended with. Many want to down size because taxes and interest rates make there current home no longer affordable. Many people need to de-leverage, or down size or create more income (you can either cut expenses or increase revenue). What ever your particular situation demands now is time to reexamine your portfolio and rebalance the mix of assets and debt.

Investing in Real Estate was propelled by three basic trends:

1) Demographics (certain age groups follow certain lifestyle changes).

2) Interest rates were and are historically low (the cost of funds).

3) The failure of alternate investments to maintain market returns ie…stocks, bonds and commodities (Different economic environments create advantages for different asset classes)

Don’t generalize on the real estate market; it is very local creating different situations for different investors. So look at your specific situation in your area. Raising ARM's and property taxes will put a lot of people under financial pressure. This creates lots of opportunity for those that have the cash. Generally it is thought that as real estate gets weaker then the stock market will improve. However raising interest rates often push stock prices down. I think the last few years have been very unusual for real estate due to the extra low level of interest rates and super positive demographics. With raising interest rates this process has begun to unwind it self.

James

www.jamesfoytlin.com

Hello,

Ok since you keep asking me about real estate;

Investor look to put capital to work to generate the maximum return weather it is real-estate, equities or anything else. Different economic situations create different sets of opportunities. Low interest rates and a declining stock market made real estate very appealing ,but The longest period of interest rate increases in a quarter of a century has begun to significantly impact the real estate market. Many people in real estate are trapped with huge mortgages and creeping property taxes or second homes that they find them selves over extended with. Many want to down size because taxes and interest rates make there current home no longer affordable. Many people need to de-leverage, or down size or create more income (you can either cut expenses or increase revenue). What ever your particular situation demands now is time to reexamine your portfolio and rebalance the mix of assets and debt.

Investing in Real Estate was propelled by three basic trends:

1) Demographics (certain age groups follow certain lifestyle changes).

2) Interest rates were and are historically low (the cost of funds).

3) The failure of alternate investments to maintain market returns ie…stocks, bonds and commodities (Different economic environments create advantages for different asset classes)

Don’t generalize on the real estate market; it is very local creating different situations for different investors. So look at your specific situation in your area. Raising ARM's and property taxes will put a lot of people under financial pressure. This creates lots of opportunity for those that have the cash. Generally it is thought that as real estate gets weaker then the stock market will improve. However raising interest rates often push stock prices down. I think the last few years have been very unusual for real estate due to the extra low level of interest rates and super positive demographics. With raising interest rates this process has begun to unwind it self.

James

www.jamesfoytlin.com

Earnings are Meaningless?

from my friends at bondheads ....yea the yeild curve is looking pretty flat...Lets face it this market is driven by one thing and one thing only Interest Rates! If there is one thing we have learned the last couple of years is that cash flow, earnings, cash on hand have not had a meaningful effect on the current market ,it is all about interest rates and stocks have been acting like a fish swimming up stream.

from my friends at bondheads ....yea the yeild curve is looking pretty flat...Lets face it this market is driven by one thing and one thing only Interest Rates! If there is one thing we have learned the last couple of years is that cash flow, earnings, cash on hand have not had a meaningful effect on the current market ,it is all about interest rates and stocks have been acting like a fish swimming up stream.

Monday, June 19, 2006

Sunday, June 18, 2006

Investment Tip of the Day

Investors only need two things time and money most of us have at lest one. Figure out which one you have the most of and invest accordingly.

Wednesday, June 14, 2006

Perceptions

Will the summer slow down to put the breaks on the FED,thats the question?

Has the FED chair made an effort to change the preception from the FED is finished to the FED has a lot more to go to achieve the greatest impact when the FED stops raising rates later this summer ?

Normaly a new FED chair comes in and raises rates to prove himself an inflation fighter ,but given the flattness of the yield curve ,long term inflation seems no where to be found. So this blogger thinks the FED has looked to change the perception of interest rate moves instead of actualy change the policy.

Tuesday, June 13, 2006

Dont start taking hostages....

During corrections a new group of stocks will emerge as market leaders once a bottom does occur. Right now keep a close eye on those stocks which are holding up the best and developing a favorable chart pattern. What makes this one extra tuff is that after 5 years of Bear markets everyone’s hopes had been raised by a more positive market environment since the end of last year. Before you start thinking about taking hostages lets just look at the statistical technical facts:

As of last week ,S&P 500 it has fallen around 90 points or 7% the past five weeks and also has broken below its 40 Weekly EMA (blue line). However so far the S&P 500 has held support above the 1230 level which is an important longer term support area that coincides with its upward sloping trend line (brown line) originating from the August 2004 low and its 38.2% Retracement Level (calculated from the August 2004 low to the most recent high).

The Nasdaq has fallen around 275 points or 11.6% since peaking in early April and broke below a key longer term support level this week near the 2135 area. The 2135 area corresponded to the Nasdaq's 38.2% Retracement Level (calculated from the August 2004 low to the April 2006 high) and also was along its upward sloping trend line (brown line) originating from the August 2004 low as well.

The Dow has dropped around 900 points or 7.8% since peaking in early May and failed to hold support at its 40 Weekly EMA (blue line) this week. If the Dow remains under more selling pressure the next area of support appears to be at its 50% Retracement Level (calculated from the October 2004 low to its most recent high) near 10700. The 10700 level is also where the Dow found support at in the late part of 2005 into the early part of 2006 as well (point A). If the Dow fails to hold support at the 10700 level then the next downside support area would be just below 10500 which corresponds to its 61.8% Retracement Level and upward sloping trend line (brown line) originating from the October 2004 low.

As of last week ,S&P 500 it has fallen around 90 points or 7% the past five weeks and also has broken below its 40 Weekly EMA (blue line). However so far the S&P 500 has held support above the 1230 level which is an important longer term support area that coincides with its upward sloping trend line (brown line) originating from the August 2004 low and its 38.2% Retracement Level (calculated from the August 2004 low to the most recent high).

The Nasdaq has fallen around 275 points or 11.6% since peaking in early April and broke below a key longer term support level this week near the 2135 area. The 2135 area corresponded to the Nasdaq's 38.2% Retracement Level (calculated from the August 2004 low to the April 2006 high) and also was along its upward sloping trend line (brown line) originating from the August 2004 low as well.

The Dow has dropped around 900 points or 7.8% since peaking in early May and failed to hold support at its 40 Weekly EMA (blue line) this week. If the Dow remains under more selling pressure the next area of support appears to be at its 50% Retracement Level (calculated from the October 2004 low to its most recent high) near 10700. The 10700 level is also where the Dow found support at in the late part of 2005 into the early part of 2006 as well (point A). If the Dow fails to hold support at the 10700 level then the next downside support area would be just below 10500 which corresponds to its 61.8% Retracement Level and upward sloping trend line (brown line) originating from the October 2004 low.

Monday, June 12, 2006

Banned Artist

She has been banned, she is controversial and now she is in Ridgewood painting live find out what all the fuss is about with special guests Rich and Royal and the Bloodsugars .

Solo Exhibition"Life of an Artist"C. Magor Gallery21 Oak StreetRidgewood, NJ 07450 June 22, 2006 thru July 6, 20061st Open Reception- June 22, 2006-5-9pm (live painting)2nd Open Reception-June 29,2006-5-9pm

Friday, June 09, 2006

Sell in May and go away?

Hello,

Sell in May and go away? Or perhaps an Omen from 666, either way it hasn’t been the best of times for stock markets around the world. While the FED fiddles the markets burns. It appears the FED has introduced a policy of as Yogi Berra said,” if you see a fork in the road, take it”. If that doesn’t work you can just muddle away and hope something happens to make your job easier. Even when the FED told us they remained vigilant the markets seem to be exhibiting a lack of confidence, which is not uncommon with a new FED chair. My feeling at the moment is that the annual summer slow down in the economy is already at hand which will in turn get the FED to head for the beach and take a rest inspiring the market to once again resume its upward move.

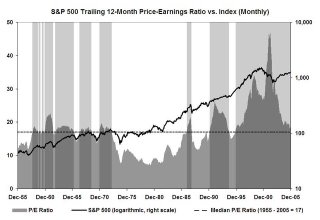

Are commodities over valued and heading for a bust? It is interesting to note that the CRB Commodity index which has been credited with a parabolic raise since its low in October 2002 and is up 53%, while the S&P 500 is up 58% in the same period. Mind you the CRB has just emerged form a 20 year bear market .While the S&P in my mind has been in a bear market since March 2000 and is currently trading at the cheapest earnings multiple in over 20 years. I have also heard some silly talk that this market is like 1987 ,forgive me for laughing but the Dow tumbled almost 25% in one day ,that would be like the Dow dropping around 3000 points in one day now. It is also my duty to point out that the Dow had rallied beginning in 1982 and almost tripled from were it started, that would be like seeing the NASDQ around 15,000 right now. My point being again that stock and commodity markets are far from over valued and by a long term view still relatively cheap.

So it is not the 1970’s but what everyone should be asking is it 1982 all over again? With the largest US corporations sitting on a record $640 billion in cash it is no wonder that many market observers are calling this 1982 all over again. 375 companies in the S&P 500 have over 62 weeks of income in there pockets which could be used to fuel, mergers acquisitions and leveraged buyouts (LBO’s).Merger mania in the early 1980’s preceded the 1982-2000 bull market. This creates an explosive combination where a low equity valuation meets lots of cash rich and low debt companies.

James

www.jamesfoytlin.com

Sell in May and go away? Or perhaps an Omen from 666, either way it hasn’t been the best of times for stock markets around the world. While the FED fiddles the markets burns. It appears the FED has introduced a policy of as Yogi Berra said,” if you see a fork in the road, take it”. If that doesn’t work you can just muddle away and hope something happens to make your job easier. Even when the FED told us they remained vigilant the markets seem to be exhibiting a lack of confidence, which is not uncommon with a new FED chair. My feeling at the moment is that the annual summer slow down in the economy is already at hand which will in turn get the FED to head for the beach and take a rest inspiring the market to once again resume its upward move.

Are commodities over valued and heading for a bust? It is interesting to note that the CRB Commodity index which has been credited with a parabolic raise since its low in October 2002 and is up 53%, while the S&P 500 is up 58% in the same period. Mind you the CRB has just emerged form a 20 year bear market .While the S&P in my mind has been in a bear market since March 2000 and is currently trading at the cheapest earnings multiple in over 20 years. I have also heard some silly talk that this market is like 1987 ,forgive me for laughing but the Dow tumbled almost 25% in one day ,that would be like the Dow dropping around 3000 points in one day now. It is also my duty to point out that the Dow had rallied beginning in 1982 and almost tripled from were it started, that would be like seeing the NASDQ around 15,000 right now. My point being again that stock and commodity markets are far from over valued and by a long term view still relatively cheap.

So it is not the 1970’s but what everyone should be asking is it 1982 all over again? With the largest US corporations sitting on a record $640 billion in cash it is no wonder that many market observers are calling this 1982 all over again. 375 companies in the S&P 500 have over 62 weeks of income in there pockets which could be used to fuel, mergers acquisitions and leveraged buyouts (LBO’s).Merger mania in the early 1980’s preceded the 1982-2000 bull market. This creates an explosive combination where a low equity valuation meets lots of cash rich and low debt companies.

James

www.jamesfoytlin.com

Wednesday, June 07, 2006

the Wall of Worry

tug of war with the new FED chief

Investors continue to be caught in the raging tug of war between the new FED chief Bernanke and the bond markets .While short term rates have gone up significantly the last couple of years, long rates remain stubbornly moderate. The lack of follow thru from short to long rates implies little or no threat of runaway inflation in the long run.

Tuesday, June 06, 2006

Apocalypse ,its 666

2006-06-06(oh my)

Hello,

Folks its may look like it but it’s not 666 for this market.The current earnings are of much higher quality than in a very long time as for P/E's the market multiply is lower than any time since the 1970's .P/E's in the 1980's and 1990's was more like the low 20's. I hate to burst everyones bubble but this aint the 1970's or the 1930's as for the market making a move ,tranistions from long term bear to bull create a lot of volitility and a lot of false starts ,yesterdays rally may not signal a trend but it was still a broad based rally

So it is not the 1970’s but what everyone should be asking is ,is it 1982 all over again? With the largest US corporations sitting on a record $640 billion in cash it is no wonder that many market observers are calling this 1982 all over again. 375 companies in the S&P 500 have over 62 weeks of income in there pockets which could be used to fuel, mergers acquisitions and leveraged buyouts (LBO’s).Merger mania in the early 1980’s preceded the 1982-2000 bull market. This creates an explosive combination where a low equity valuation meets lots of cash rich and low debt companies.

The market needs the FED to be more constructive to really get going. And as of yet the FED is not giving what we want to hear. It is a stock pickers market both for short and long's . Recent FED minutes seem to imply that the FED is as much confused by the conflicting data as you or I, but the silver lining is that the minutes suggest that the FED no longer has a predisposition to raise or to stop raising. The current FED policy seems to resemble the Yogi Berra advise “if you see a folk in the road take it”. The FED talks tuff but I am not sure that represents policy as much as it reasures investors that the FED is hawkish on inflation.

Interesting to note that the bond market does not seemed confused and is telling us that there is NO global inflation because of the enourmous productivity gains the last several years...hummmJames

Hello,

Folks its may look like it but it’s not 666 for this market.The current earnings are of much higher quality than in a very long time as for P/E's the market multiply is lower than any time since the 1970's .P/E's in the 1980's and 1990's was more like the low 20's. I hate to burst everyones bubble but this aint the 1970's or the 1930's as for the market making a move ,tranistions from long term bear to bull create a lot of volitility and a lot of false starts ,yesterdays rally may not signal a trend but it was still a broad based rally

So it is not the 1970’s but what everyone should be asking is ,is it 1982 all over again? With the largest US corporations sitting on a record $640 billion in cash it is no wonder that many market observers are calling this 1982 all over again. 375 companies in the S&P 500 have over 62 weeks of income in there pockets which could be used to fuel, mergers acquisitions and leveraged buyouts (LBO’s).Merger mania in the early 1980’s preceded the 1982-2000 bull market. This creates an explosive combination where a low equity valuation meets lots of cash rich and low debt companies.

The market needs the FED to be more constructive to really get going. And as of yet the FED is not giving what we want to hear. It is a stock pickers market both for short and long's . Recent FED minutes seem to imply that the FED is as much confused by the conflicting data as you or I, but the silver lining is that the minutes suggest that the FED no longer has a predisposition to raise or to stop raising. The current FED policy seems to resemble the Yogi Berra advise “if you see a folk in the road take it”. The FED talks tuff but I am not sure that represents policy as much as it reasures investors that the FED is hawkish on inflation.

Interesting to note that the bond market does not seemed confused and is telling us that there is NO global inflation because of the enourmous productivity gains the last several years...hummmJames

Monday, June 05, 2006

Just the facts mam......

Revised Report Shows Fastest Real GDP Growth In Two-And-A-Half Years. Real GDP grew at an annual rate of 5.3 percent for the first quarter of this year. This follows our economic growth of 3.5 percent in 2005 - the fastest rate of any major industrialized nation.

Productivity Increased At A Strong Annual Rate Of 3.7 Percent In The First Quarter.

Real Hourly Compensation Rose At A 3.2 Percent Annual Rate In The First Quarter.

Personal Income Increased At An Annual Rate Of 6.7 Percent In April. Since January 2001, real after-tax income has risen by 12.9 percent, or 7.3 percent per person.

Real Consumer Spending Increased At An Annual Rate Of 5.2 Percent In The First Quarter.

Employment Increased In 47 States Over The Past 12 Months Ending In April. Nonfarm payroll employment increased in 41 states in April.

Industrial Production Increased 4.7 Percent Over The Past 12 Months. Over the past 12 months, manufacturing production has increased by 5.5 percent

Productivity Increased At A Strong Annual Rate Of 3.7 Percent In The First Quarter.

Real Hourly Compensation Rose At A 3.2 Percent Annual Rate In The First Quarter.

Personal Income Increased At An Annual Rate Of 6.7 Percent In April. Since January 2001, real after-tax income has risen by 12.9 percent, or 7.3 percent per person.

Real Consumer Spending Increased At An Annual Rate Of 5.2 Percent In The First Quarter.

Employment Increased In 47 States Over The Past 12 Months Ending In April. Nonfarm payroll employment increased in 41 states in April.

Industrial Production Increased 4.7 Percent Over The Past 12 Months. Over the past 12 months, manufacturing production has increased by 5.5 percent

1982 all over again?

Is it 1982 all over again? With the largest US corporations sitting on a record $640billion in cash it is no wonder that many market observers are calling this 1982 all over again. 375 companies in the S&P 500 have over 62 weeks of income in there pockets which could be used to fuel, mergers acquisitions and leveraged buyouts (LBO’s).Merger mania in the early 1980’s preceded the 1982-2000 bull market. This creates an explosive combination where low equity valuations meets lots of cash rich and low debt companies.

Friday, June 02, 2006

No Predisposition from the FED

The current earnings are of much higher quality than in a very long time as for P/E's the market multiply is lower than the 1970's .P/E's in the 1980's and 1990's was more like the low 20's. I hate to burst everyones bubble but this aint the 1970's or the 1930's as for the market making a move ,tranistions from long term bear to bull create a lot of volitility and a lot of false starts ,yesterdays rally may not signal a trend but it was still a broad based rally .

The market is extremely undervalued but that dosnt mean it wont stay that way it is just very cheap ie look at all the take overs and public companies going private .The market needs the FED to be more constructive to really get going. It is a stock pickers market both for short and long's . Recent FED minutes seem to imply that the FED is as much confused by the conflicting data as you or I, but the silver lining is that the minutes suggest that the FED no longer has a predisposition to raise or to stop raising. So perhaps the rally of the last couple of days is saying 1/2 a loof is better than none.

Interesting to note that the bond market does not seemed confused and is telling us that there is NO global inflation because of the enourmous productivity gains the last several years...hummm

James

The market is extremely undervalued but that dosnt mean it wont stay that way it is just very cheap ie look at all the take overs and public companies going private .The market needs the FED to be more constructive to really get going. It is a stock pickers market both for short and long's . Recent FED minutes seem to imply that the FED is as much confused by the conflicting data as you or I, but the silver lining is that the minutes suggest that the FED no longer has a predisposition to raise or to stop raising. So perhaps the rally of the last couple of days is saying 1/2 a loof is better than none.

Interesting to note that the bond market does not seemed confused and is telling us that there is NO global inflation because of the enourmous productivity gains the last several years...hummm

James

Subscribe to:

Posts (Atom)